Think Mobile Apps Are a Luxury? Here's the Data That Proves They're a Financial Necessity

Introduction: The Silent Drain on Your Revenue

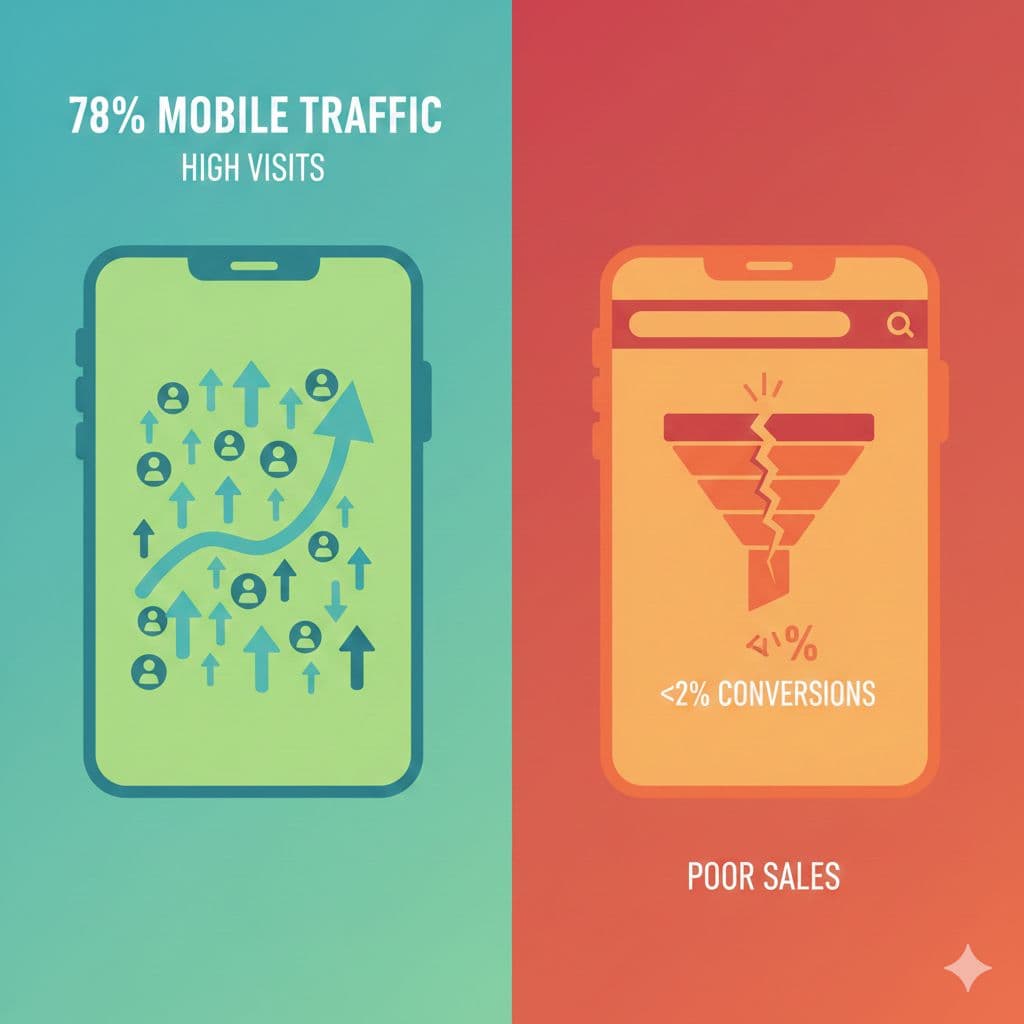

For leaders of growing e-commerce brands, the data can be maddening. You see mobile traffic skyrocketing, often accounting for the vast majority of your visitors, yet mobile sales figures remain stubbornly disappointing. You're paying a premium to acquire customers through social and search, only to watch them abandon carts or bounce from your site at an alarming rate on their phones. This isn't a marketing problem; it's a structural one.

This common frustration is known as the "Mobile Revenue Paradox"—a critical inefficiency where your primary channel for customer traffic is also your worst-performing channel for converting it. The mobile website, despite being the main entry point for your brand, is a leaky bucket that represents an active financial hemorrhage, distorting your unit economics with every lost sale.

This article will not rehash vague arguments about branding or engagement. Instead, we will reveal four counter-intuitive financial truths, backed by hard data, that reframe a native mobile app from a "nice-to-have" marketing expense into a critical piece of financial infrastructure. These truths expose the real, and often hidden, costs of relying solely on the mobile web.

1. Your Biggest Traffic Source is Your Worst Performing Channel

The core of the problem lies in the "Mobile Revenue Paradox," a stark and costly divergence between where your customers are and where they actually buy. The data is unequivocal: mobile devices dominate e-commerce traffic, driving between 70% and 75% of all visits, and in verticals like fashion and personal care, this figure frequently exceeds 98%. Yet, this firehose of traffic is being funneled into an infrastructure that is fundamentally broken for commerce.

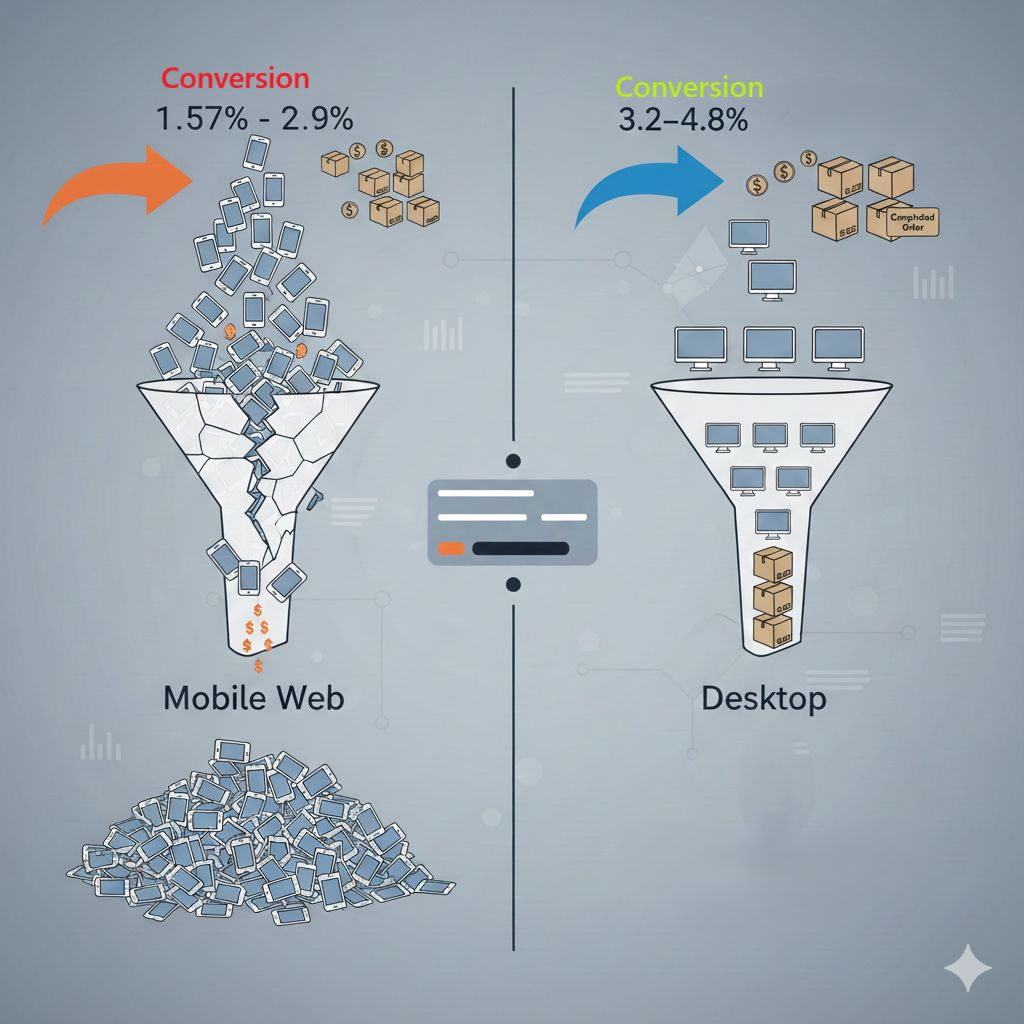

Consider the vast performance gap highlighted by industry benchmarks:

• Desktop Conversion: 3.2% to 4.8%

• Mobile Web Conversion: 1.57% to 2.9%

Despite commanding the lion's share of attention, the mobile web converts at roughly half the rate of desktop. This isn't a minor discrepancy; it's an infrastructure failure. Brands are paying increasingly high customer acquisition costs (CAC) to drive the majority of their potential customers into their least efficient conversion channel.

The brand is effectively paying peak acquisition costs for sub-optimal yield. This is not a marketing failure; it is an infrastructure failure.

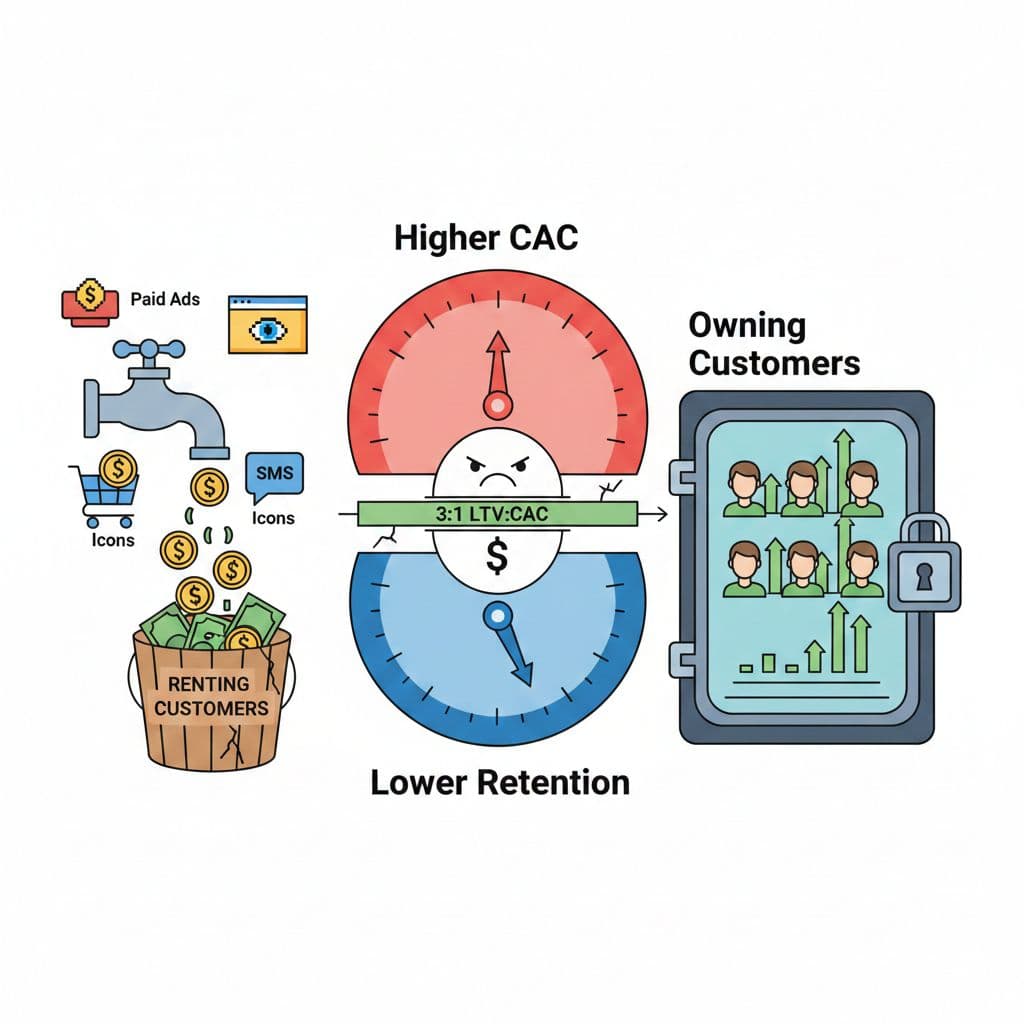

This flawed infrastructure forces brands into a precarious financial model. Because the mobile web is ephemeral and cookie-dependent, re-engaging a user requires constantly paying gatekeepers like Meta and Google for access. In effect, you are trapped in a cycle of "renting" your own customers, paying high CAC to funnel them back into your leakiest channel, only to lose them and pay to rent them again.

2. The Technical Drivers of a 3x Conversion Lift

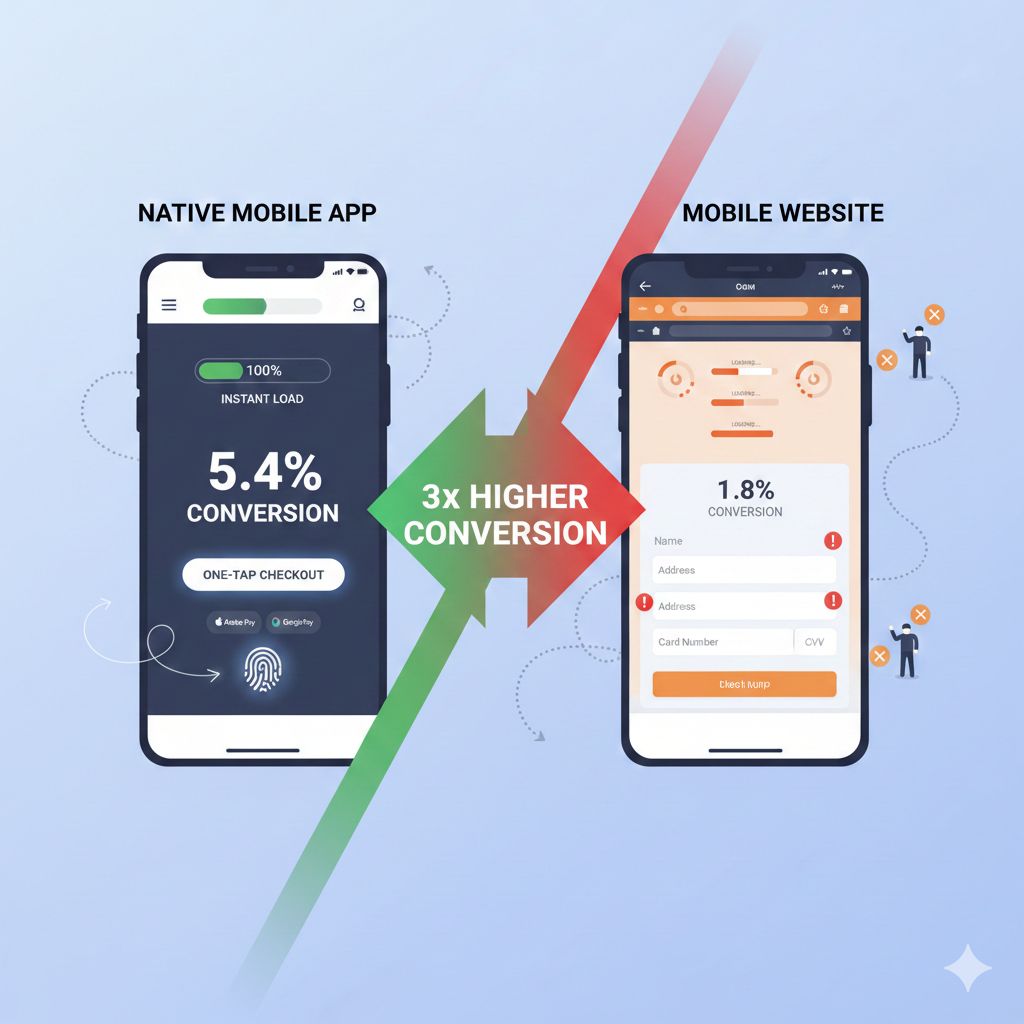

The single most powerful economic argument for a native app is its staggering conversion efficiency. Across the board, native apps consistently convert users at a rate 3 times higher than mobile websites. For a brand whose mobile site converts at 1.8%, its app can be conservatively modeled to convert at 5.4%.

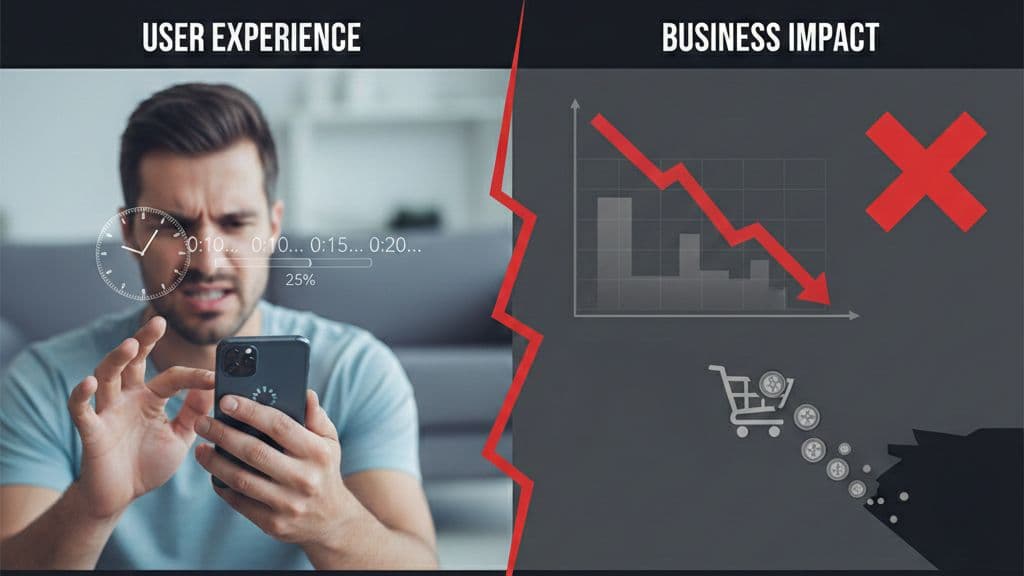

This lift is not the result of marketing tactics; it is a direct consequence of superior engineering. Native apps are compiled code running directly on the device's operating system, storing the user interface (UI) and core assets locally. A mobile website, by contrast, is interpreted code running inside a browser that must fetch and load every element—headers, images, scripts—from a server every single time a user clicks. This architectural difference eliminates the "latency penalty" that plagues the mobile web, where every 1-second delay in page load time reduces conversions by 20%, and 53% of users abandon a site that takes longer than 3 seconds to load.

Furthermore, native apps dismantle the primary cause of cart abandonment: checkout friction. By integrating directly with Apple Pay, Google Pay, and biometric authenticators like FaceID, apps transform a cumbersome, multi-field data entry task into a seamless, one-tap transaction. This fundamental change systematically removes the greatest barriers to completing a purchase.

3. Myth Busted: Apps Create New Revenue, They Don't Just "Steal" It from Your Website

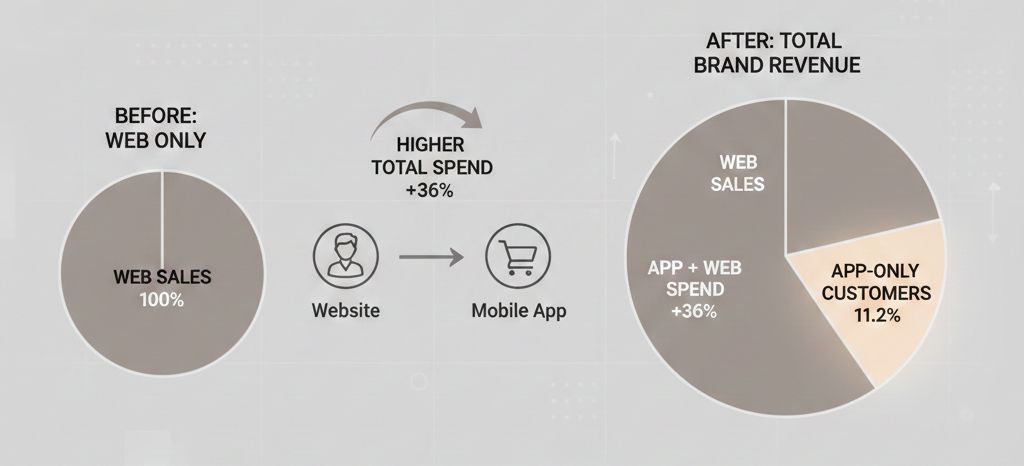

The most sophisticated objection to investing in an app is the "Cannibalization Argument": Are we just paying to move the same sales from the web to an app? The fear is that an app doesn't create new value but simply shifts existing revenue from one channel to another, adding cost without adding growth.

However, a comprehensive analysis of 330 million orders proves this objection is unfounded. The data provides definitive proof that apps generate significant incremental revenue, growing the brand's entire financial pie.

Two key findings debunk the cannibalization myth:

1. Spend Lift: When a customer begins using a brand's app in addition to the web, their total spending with that brand increases by an average of 36%. Even if their web spending slightly declines, their aggregate spend rises dramatically. The app creates more valuable customers overall.

2. The "App-Only" Customer: The analysis uncovered a new and vital customer segment: "App-first, App-only" shoppers. This group accounts for 11.2% of new customers and exclusively makes purchases through the native app. In a web-only model, this high-value cohort is completely inaccessible.

Putting It Into Practice: A Quick Financial Model

To understand the impact, we must separate cannibalized revenue from net incremental revenue. Consider a brand with 40,000 high-intent mobile users.

• On the mobile web (1.5% conversion, 80AOV),theywouldgenerate∗∗48,000**.

• On an app (4.5% conversion, 90AOV),theygenerate∗∗162,000**.

The net incremental revenue is not the full 162,000. this is the app revenue minus what those same users would have spent on the web anyway(48,000). The result is $114,000 per month in new revenue—money that would not exist without the app's superior performance.

The data is clear: an app grows the entire revenue pie, it doesn't just slice it differently. It captures sales that would otherwise be lost to friction or competitors. Without an app, 11.2% of your potential new customers may not exist at all.

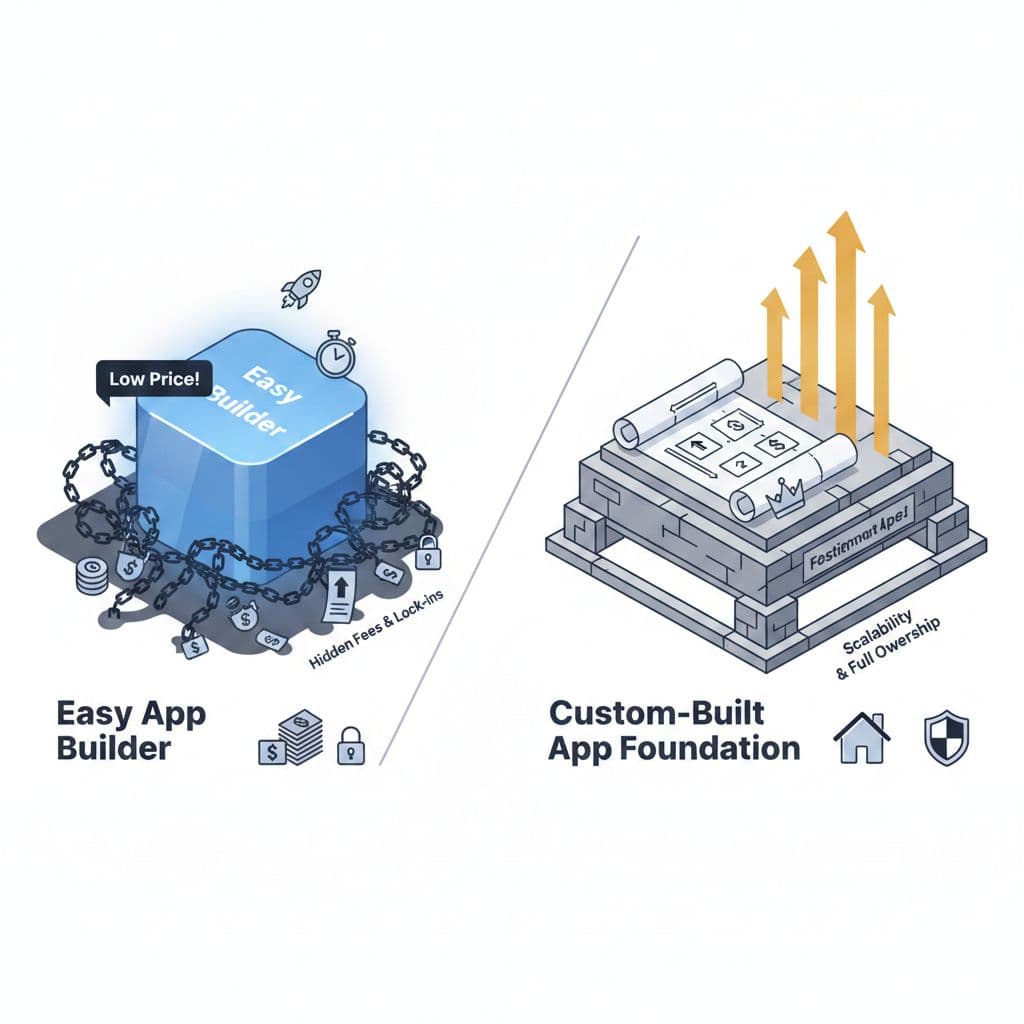

4. The SaaS "Rental" Model is a Financial Trap Disguised as a Low-Cost Solution

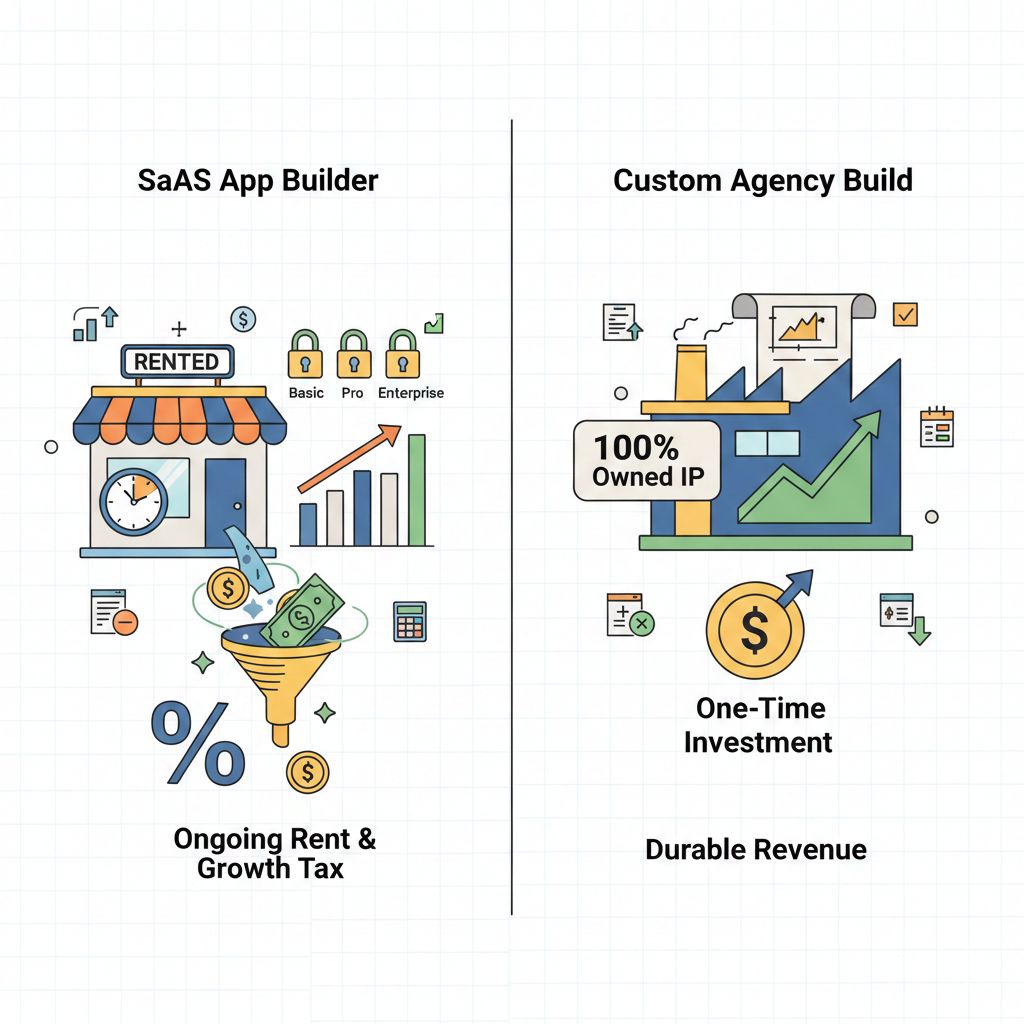

The choice between a SaaS builder and a custom agency build is not about features; it's a fundamental balance sheet decision: are you acquiring a revenue-generating asset or taking on a growth-punishing liability? Many brands are lured by the promise of SaaS app builders—low upfront costs and a simple monthly fee. However, a 3-year Total Cost of Ownership (TCO) analysis reveals this is often a financial trap designed to penalize growth.

This "SaaS Tax" manifests in two ways:

• Escalating Tiers: Critical features are often locked behind expensive enterprise plans, forcing successful brands into subscriptions costing $999 to $1,350+ per month.

• Transaction Fees: A seemingly small 1% fee on app revenue becomes a direct tax on success, costing a brand generating 10 min annual sales add an extra ∗∗100,000 per year**.

When compared to a one-time investment in a custom agency build that creates Owned IP, the long-term financial picture is inverted. A TCO analysis shows that while the agency build has a higher upfront cost, it is significantly cheaper over a three-year period and results in a valuable, permanent asset.

| Cost Model | 3-Year Total Cost of Ownership | Asset Value at Year 3 |

| High-Tier SaaS Builder | $103,200 | $0 (Rental/Liability) |

| Custom Agency Build | $55,000 | High (Owned Asset) |

The "Agency Equity" model not only saves $48,200 in cash over three years but also creates a permanent asset on the balance sheet. The SaaS model is a liability that punishes growth through transaction fees.

--------------------------------------------------------------------------------

Conclusion: Stop Renting Your Customers, Start Owning Your Revenue

In 2025, a native mobile app is no longer a marketing "nice-to-have." It is a critical financial tool for correcting flawed unit economics, reducing Blended CAC by shifting retention from paid ads to free push notifications, and building long-term enterprise value. The data shows that relying on the mobile web means accepting a structural disadvantage that leaks revenue, inflates costs, and surrenders your customer relationships to third-party platforms.

An app closes the conversion gap, creates new revenue streams from previously unreachable customers, and provides a more cost-effective financial model for growth. It moves you from "renting" your audience to owning your revenue channel. The question for growing brands is no longer if you can afford a native app, but how much longer you can afford to leak revenue without one?

Related In-Depth Guides

4 Surprising Truths About Mobile Apps That Will Change How You Think About Growth

Introduction: The Mobile ParadoxIf you're leading a growing business, you've likely felt this frustration: you look at your analytics and see the vast majority of your web traffic—around 78%—is coming from mobile devices. Yet, when you look at your sales data, you see that the conversion rate on the mobile web is stubbornly low, often under 2%.This is the Mobile Revenue Paradox. Companies are spending significant capital to acquire traffic that arrives through a channel that is fundamentally inefficient at converting it. It’s like pouring water into a leaky sieve. You're paying for potential customers who show interest but disappear before they can complete a purchase, threatening the long-term unit economics of your business.The common response is to avoid investing in a native app, fearing it will only "cannibalize" sales from the website without adding new revenue. But this fear is based on a fundamental misunderstanding of modern digital economics. Here are four surprising truths that challenge this old way of thinking and reveal where real mobile growth comes from.1. The "Cannibalization" Myth: Apps Don't Steal Sales, They Save ThemThe most common objection to building an app is the fear of "cannibalization"—the idea that an app only shifts your existing customers from the website without generating new revenue, all while adding significant cost.This view, however, fails to account for the enormous "friction cost" of the mobile web experience. The browser is an environment plagued by issues like slow load times, session volatility, and a lack of persistent identity, creating a path to purchase filled with obstacles:• Login Fatigue: The constant and annoying need to sign in, often after forgetting a password.• Cumbersome Checkouts: The difficulty of entering detailed payment and shipping information on a small screen.• High Cart Abandonment: As a result of these frustrations, an astonishing average of 85.65% of mobile shopping carts are abandoned before purchase.This isn't cannibalization; it's loss prevention. Given that 85.65% of mobile web carts are abandoned, revenue shifted to an app is revenue rescued from the brink of abandonment. The app's role isn't that of a cannibal, but of a rescue mechanism that saves fragile revenue and reduces churn among your most valuable customers.2. The Conversion Gap: A 157% Lift Isn't a Typo, It's the StandardThe most immediate and undeniable source of new value from an app is its dramatically higher conversion rate. While mobile web conversion rates languish around 1-2%, native app conversion rates frequently hit 6% or higher. This is the efficiency gap where incremental revenue is born.Data indicates that mobile apps convert at rates 157% higher than mobile websites.This performance gap is not accidental; it is the direct result of superior engineering. Native apps offer a superior user experience (UX) with faster load times and remove the biggest barriers to completing a purchase. With seamless, one-click payment integrations like Apple Pay and Google Pay, the checkout process goes from a tedious chore to an effortless action.These are not cannibalized sales. This is realized potential that the mobile web was incapable of capturing. The app unlocks revenue from users who had the intent to buy but were stopped by the friction of the browser experience—revenue that simply would not have existed otherwise.3. Beyond the First Purchase: Apps Create "Super Users" with Up to 7x Higher Lifetime ValueWhile the initial conversion lift is powerful, the true long-term value of an app lies in its ability to fundamentally change customer behavior. This stems from a core strategic difference: the mobile web is "rented" attention, while an app is "owned" real estate on a customer's home screen.This ownership fundamentally alters engagement patterns. The data shows that app users have a 2x higher repeat purchase rate and spend 3-5x more time engaging with the brand. A key driver is the push notification—a direct, zero-cost re-engagement channel with open rates hovering around 60% and click-through rates of 15%. This allows you to bring customers back without paying for expensive retargeting ads.When you combine higher conversion rates, more frequent purchases, and a lift in Average Order Value (AOV) of +10% to +50%, you dramatically expand customer Lifetime Value (LTV). The data is unequivocal: app users can generate a lifetime value that is 3.5 to 7 times higher than mobile web users. The goal is not just to make a sale; it's to upgrade a casual customer into a high-value, long-term asset.4. Your App Isn't an Expense—It's a Balance Sheet AssetPerhaps the most surprising truth is how a mobile app is viewed from a financial and strategic perspective. Many leaders see an app as a major marketing expense (OpEx) that will hurt short-term profits. However, under US GAAP, specifically ASC 350-40, the accounting treatment is far more strategic.App development costs are segmented into three stages. The "Preliminary Project Stage" (ideation, vendor selection) is expensed (OpEx). However, the bulk of the cost—the "Application Development Stage" (design, coding, testing)—is capitalized (CapEx). The final "Post-Implementation Stage" (maintenance, training) is again treated as an expense.This has profound strategic importance. By capitalizing the core development cost, the app is treated as a long-term intangible asset on your company's balance sheet, much like property or equipment. This enhances your company's enterprise value, making it more attractive to investors. It transforms the app from a "cost center" into an investable asset that represents true digital sovereignty—ownership of your customer relationships, independent of third-party platforms.Conclusion: The Real Cost of Doing NothingThe long-held fear of cannibalization ignores the very real, ongoing cost of mobile web friction and inefficiency. The data is clear: an app is not a luxury channel for a select few, but a strategic tool for converting traffic, retaining customers, and building tangible enterprise value.By shifting your perspective, you can see that an app doesn't steal sales—it saves them. It doesn't just shift revenue—it creates new revenue by closing the conversion gap. And it doesn't just cost money—it builds real, measurable value on your balance sheet.This leads to a final, critical question. In an economy where 78% of your traffic arrives through a channel that converts at less than 2%, the real question isn't "Can we afford an app?" but rather, "How much longer can we afford the cost of inaction?"

Your Mobile Website Is Secretly Costing You Millions. Here's How.

Introduction: The Mobile ParadoxE-commerce leaders face a frustrating reality. Mobile devices drive the overwhelming majority of traffic—often 70-75% of all visits—yet conversion rates remain stubbornly low, hovering between 1.57% and 3%. This gap between massive traffic and disappointing revenue is not a minor issue to be optimized; it is a structural financial hemorrhage. For too long, reliance on a mobile-web-first strategy has been viewed as a neutral technology choice. It is now an active liability that erodes EBITDA.This analysis exposes the hidden costs your business pays every day for this liability. We call it the "Silent Tax"—a constant drain on your profitability levied through two compounding vectors: the crippling financial penalty of latency and the ever-increasing cost of wasted ad spend.1. You're Being Penalized for Being Slow (And You're Slower Than You Think)The relationship between your mobile site's loading speed and your revenue is not linear—it is an exponential cliff. The longer a customer waits, the less likely they are to ever complete a purchase. This is the latency penalty.The core statistic is staggering: for every one-second delay in mobile page load time, conversion rates drop by approximately 20%. This penalty accumulates with breathtaking speed. Research shows that 53% of mobile users will abandon a site completely if it takes more than three seconds to load. In practical terms, this means for every $100,000 you spend on ads, $53,000 is incinerated before a user even sees a single product."A mobile site that loads in 4 seconds is not merely 'slower' than a site that loads in 2 seconds; it is structurally incapable of generating the same revenue volume."Native apps solve this problem through architectural superiority. Unlike a website that must fetch its interface from a remote server on every visit, a native app stores its core user interface on the device’s local NAND flash memory. This provides "Zero Network Dependency for UI," leveraging hardware acceleration to make the experience feel instant, eliminating the cognitive drift that kills conversions.2. You're Paying Rent to Talk to Your Own CustomersFor years, the standard e-commerce playbook has been to pay platforms like Meta and Google to constantly "retarget" and re-acquire your own customers. This "Rentership Economy" is a fundamentally broken model that destroys the unit economics of the business.Customer Acquisition Costs (CAC) have surged by 40% to 60% over the last two years, making this rental model financially unsustainable. The problem is compounded by the "Signal Loss" crisis. Privacy changes like Apple's App Tracking Transparency (ATT) and the end of third-party cookies have decimated the fidelity of retargeting through two mechanisms:• Match Rate Collapse: The inability to reliably identify your website visitor as the same user on Instagram or Facebook.• Attribution Obscurity: The inability to accurately track which ads lead to sales, forcing brands to fly blind with their ad spend.A native app offers an escape from this rental trap through an "owned" model. Push notifications provide a direct, free, and algorithm-proof line of communication to your customers, fundamentally altering the economics of retention."The shift to an app is a shift from 'OpEx' (Paid Media) to 'Asset Utilization' (Owned Media)."3. Your App Isn't an 'IT Expense'—It's Your Most Valuable Real EstateA fundamental psychological shift occurs when a customer installs your app. A mobile website is a "destination" they must actively seek out. A native app is a "resident" on their device's home screen—the most valuable digital real estate in the world.This constant presence creates a "Default Bias," building habit loops and serving as a persistent brand impression that the mobile web can never replicate. Furthermore, the app functions as a competitive "Moat." Once a user is inside your app, they are insulated from the Google Shopping ads and competitor promotions that litter the open web.For this reason, brands must stop viewing an app as an "IT expense" and start seeing it as a financial asset, akin to a flagship physical store. The Cost of Inaction (COI) quantifies this. Consider a hypothetical "Brand X" with $20 million in annual revenue. By migrating just 20% of its loyal customers to a native app that converts at a conservative 3x higher rate, the company could be paying a "Silent Tax" of over $6 million per year in lost revenue and wasted marketing spend."The debate should not be 'Can we afford the development cost?' but rather 'Can we afford the OpEx of not having this asset?'"Conclusion: Stop Paying the TaxThe "Silent Tax" of mobile web latency and ad spend wastage is not a theoretical concept; it is a real, quantifiable, and growing drain on your brand's profitability.The native mobile app is no longer a vanity project; it is a fundamental instrument of risk mitigation and capital efficiency. It is a massive profit reclamation engine. Beyond solving for latency and retention, an owned app channel serves as a critical hedge against market volatility. When ad costs spike in Q4, an app-centric brand is insulated because a large portion of its revenue comes from free, owned channels, not volatile paid auctions.The native mobile app is the necessary survival gear for scaling brands in a high-friction, high-cost digital environment. The cost of inaction is now clear. How much longer can your business afford to pay the Silent Tax?

That 1-Second Lag on Your Site? It’s Costing 20% of Your Sales.

1.0 Introduction: The Hidden Cost of a Slow Mobile SiteWe’ve all been there: tapping our fingers impatiently, waiting for a mobile website to load. What starts as mild interest quickly turns to frustration as the seconds tick by. For the user, it’s a minor annoyance—they simply close the tab and move on. For the e-commerce business behind that website, however, it’s a silent financial hemorrhage.This user frustration is the visible symptom of a much deeper problem. A slow mobile experience isn't just a technical inconvenience; it is an active and continuous drain on revenue. Every millisecond of delay directly correlates to lost conversions, devalued marketing spend, and a foundational weakness in a brand's growth strategy.This article reveals the most surprising and financially impactful truths about mobile site speed, based on hard data. We will explore the direct link between load times and conversion rates, quantify the staggering cost of inaction, and identify the only architectural solution that can permanently solve the problem.2.0 Four Surprising Truths About Mobile Speed and Your Bottom LineThe financial consequences of mobile web latency are not theoretical. The following data points illustrate the direct and severe impact that slow performance has on your revenue.Takeaway 1: Every Second of Delay Carries a 20% Conversion PenaltyThe relationship between speed and sales is alarmingly direct: a single second of delay in mobile page load time can reduce retail conversion rates by up to 20%. This isn't a small dip; it's a catastrophic drop-off for what may seem like an insignificant amount of time.For any growing brand, this functions as a perpetual "site speed penalty" that constantly drains revenue. Before a customer has even seen a product, the platform's slow performance has already cut their likelihood of making a purchase by a fifth. This penalty compounds with every additional second of delay, creating an invisible but powerful drag on profitability.To put this in concrete financial terms, consider the impact on a typical scaling brand. For a business with 500,000 monthly mobile sessions and a 200AOV,That single second of delay translates directly into a $500,000 monthly revenue hemorrhage, or $6 million in annualized losses."Empirical data establishes that even a 1-second delay in load time can result in a massive 20% reduction in retail conversion rates."Takeaway 2: You Lose Half Your Customers at the 3-Second MarkUser patience on mobile devices is virtually non-existent. The user drop-off is not gradual; it's a cliff. Data shows that when page load time increases from just 1 second to 3 seconds, the probability of a user bouncing jumps by 32%. This leads to a critical failure point: 53% of mobile users will abandon a page that takes longer than three seconds to load.This effectively devalues your marketing spend at the source. Every dollar spent on CAC to acquire a mobile visitor is immediately put at risk by a platform that is architecturally designed to fail them. A significant portion of your budget is spent acquiring customers who never even see the first product, representing a massive inefficiency built directly into your growth model.Takeaway 3: Your Biggest Channel is Your Weakest LinkThe modern e-commerce landscape is defined by a fundamental paradox: while mobile devices drive the vast majority of traffic, they are the worst-performing channel for monetization. In the United States, mobile devices account for over 56% of all web traffic, making this the primary gateway for customer acquisition.Despite this overwhelming volume, mobile websites convert at an average rate of around 2.85%, while desktops convert at a significantly higher 4.8%. This performance gap means the vast volume of traffic acquired via mobile is inherently devalued from the first click, wasting 30% to 40% of the potential value of every visitor your marketing dollars attract.Takeaway 4: Native Apps Aren't Just Faster—They Convert 3x BetterThe chronic latency that plagues the mobile web is an unavoidable result of its architecture. This is because every element on a mobile webpage—images, scripts, product data—requires a network request to a server, a process known as Round-Trip Time (RTT). The cumulative effect of these delays, which are physically unavoidable on mobile networks, creates the lag that kills conversions. The definitive solution is a native application, which is architecturally immune to these issues by storing data and key resources locally on the device.This superior architecture delivers a powerful financial outcome. Conversion rates on native apps are proven to be 3x higher than on mobile websites. By eliminating the latency penalty and capitalizing on this 3x conversion lift, the same brand can transform a 6 million annual loss into a staggering ** 60 million annual revenue gain**—all from the same volume of traffic. Furthermore, this improved experience leads to deeper engagement, with users on native apps viewing 4.2x more products per session, which naturally leads to higher average order values.3.0 Conclusion: Speed Isn't a Feature, It's Your FoundationThe data is clear: mobile web speed is not a minor technical issue to be delegated to an optimization team. It is a foundational business and financial problem that directly impacts revenue, profitability, and the efficiency of your marketing spend. The cost of inaction is a permanent drain on your P&L statement that functions as a mandatory tax on growth.Relying on a slow, architecturally flawed mobile website is a choice to accept this penalty on your growth. Now that you know a single second of delay costs you 20% of your conversions, can your business afford to continue paying that penalty every single day?

Renting vs. Owning Your App: 4 Surprising Truths About the Real Cost of Mobile App Builders

1. Introduction: The Hidden Price of "Easy"For any growing business, launching a mobile app is a major strategic goal. The immediate appeal of low-cost, template-based SaaS app builders is undeniable—they promise speed, simplicity, and a low monthly fee. However, this initial price tag is dangerously misleading. The choice is a critical financial decision where focusing on the upfront cost ignores the long-term Total Cost of Ownership (TCO). This article reveals the surprising truths that can make the "cheaper" rental option a far more expensive and strategically restrictive path for any business serious about growth.2. Takeaway 1: You're Being Taxed for Your Own SuccessMany SaaS platforms impose a "success fee," a variable cost calculated as a percentage of your app's revenue (typically 1.75% to 2.5%) that functions as a direct tax on your growth. This fee is charged on top of your fixed monthly subscription, creating a fundamental conflict of interest: the platform’s financial model actively undermines your margin health.Consider the real-world impact: for an app generating 2.5 millionin annual revenue,a1.7543,750** that year. This is the primary driver of non-linear cost acceleration, ensuring that as your business becomes more successful, your financial dependency deepens and your TCO will eventually overtake that of a custom-built solution.3. Takeaway 2: The Real Price Tag is 50-70% Larger Than You ThinkOrganizations routinely overlook 50% to 70% of total software costs, focusing only on the initial subscription fee. This is the "rental trap": a low initial cost masks a cascade of escalating Operational Expenditure (OPEX) and hidden fees. These aren't accidental oversights; they are structural components of the SaaS model, using "feature gating" to push you onto expensive Enterprise plans costing ~$1,350/month or more. This is often the only way to access functionality required for any real differentiation, such as:• Fees for essential third-party integrations.• Charges for exceeding content or product limits.• Access to crucial developer tools like Custom Blocks, Server Functions, and Web Bridge SDKs needed for a unique user experience."For high-growth businesses, the low initial subscription costs of SaaS platforms create an illusion of affordability, functioning effectively as a 'rental trap' that sacrifices long-term strategic value for immediate simplicity."4. Takeaway 3: Your Success Guarantees an Expensive BreakupSaaS builders create vendor lock-in through proprietary, low-code systems that inherently accumulate technical debt, which compromises future flexibility and robustness. As your business scales, you will inevitably hit a "scalability ceiling" where you need unique features, better performance, or complex integrations that the builder cannot support.When you outgrow the platform, you cannot take your app with you. You must pay for a complete, ground-up rebuild. This mandatory migration or "breakup cost" is the critical tipping point in the TCO analysis. This single, unplanned expense, which can cost 100,000 or more by the third year is often what causes the SaaS model’s 3-year TCO (237,100) to definitively surpass a custom build's TCO ($205,000). For a scaling brand, this isn't a risk—it is an almost certain future expense.5. Takeaway 4: A Custom App Isn't an Expense—It's a Company AssetIn contrast to the recurring OPEX of a SaaS subscription, a custom-built app is a Capital Expenditure (CAPEX) that your business owns completely. This proprietary software becomes intellectual property (IP) that acts as a valuation multiplier, directly enhancing your company's worth during funding rounds or an acquisition. The financial returns reflect this fundamental difference. Custom solutions report an average Return on Investment (ROI) of 55% over five years, significantly higher than the 42% average for SaaS implementations.This CAPEX model provides fiscal predictability. After the initial investment, costs shift to stable, predictable OPEX for maintenance, insulating the business from revenue-based cost increases and enabling clear, reliable financial planning. Ownership provides complete strategic control, superior security, and the freedom to innovate without vendor limitations.Conclusion: Are You Building an Asset or a Liability?While SaaS app builders are tempting for their low entry cost, a TCO analysis reveals they become a more expensive and restrictive path for any business serious about growth. The choice is a strategic one: commit to a rental model of accelerating, unpredictable Operational Expenditure (OPEX) that penalizes success, or invest in a Capital Expenditure (CAPEX) that creates a company asset with stable costs and long-term equity.As you plan your digital future, are you building a valuable company asset or simply renting a costly, long-term liability?

The Hidden Financial Leak Sinking Your Brand: Why Renting Customers Is a Losing Strategy

1. Introduction: The Frustrated Scaler's DilemmaFor e-commerce founders and marketers, the path to scale has never been more challenging. You’re navigating a landscape where the cost to acquire a new customer (CAC) is up 5.13%, while 75% of companies are reporting that customer retention is falling. This creates a painful squeeze on profitability, threatening the crucial 3:1 LTV to CAC ratio that defines a healthy business. To combat this, most brands double down on what they know: paid ads, retargeting campaigns, and SMS marketing to bring customers back.But what if these standard retention tactics are the problem? What if, instead of solving the issue, they are a hidden financial drain, a perpetual "rent" you pay just to speak to the customers you already acquired? This isn't just a cost of doing business; it's a fundamental flaw in a model that prioritizes renting audiences over owning them.This article will reveal the surprising ways your brand is losing money through its retention strategy. More importantly, it will show how a strategic shift from renting to owning your customer relationships can stop the bleed, transform your unit economics, and build a more profitable, defensible business.2. You're Paying a "Tax" to Talk to Your Own CustomersThink about the channels you use to re-engage past shoppers, like Meta and Google. These are Rented Channels—closed ecosystems often called "Walled Gardens" that control access to your audience. After you’ve paid to acquire a customer, these platforms charge you again, and again, just to communicate with them. It’s like having to pay a fee every time you want to call a friend who is already in your phone’s contacts.This "tax" comes in the form of retargeting costs. To show an ad to your own customer list, you typically pay a Cost Per Mille (CPM) ranging from $5 to $15. More alarmingly, these retargeting campaigns can consume a staggering 15–30% of a brand's total paid media spend. You are paying a significant portion of your budget for access to a relationship you should already own.This dependency on rented channels means you never truly own your customer data or control your financial future. Your ability to communicate is subject to the platform's changing algorithms and rising costs, creating a fragile foundation for growth.3. The Staggering Difference Between a Visitor and a FanThe gap between how a customer behaves on a mobile website versus a dedicated mobile app is shockingly wide. The data reveals that the two experiences create fundamentally different relationships with your brand.On a broad level, app users spend 7x more time in mobile apps than on mobile websites. When you isolate shopping behavior specifically, the disparity becomes even more pronounced. E-commerce app users spend an average of 201.8 minutes per month shopping. In stark contrast, mobile website users spend just 10.9 minutes per month. That's an 18.5x increase in engagement time.Why does this matter? More time leads to deeper brand loyalty and more purchasing activity. App users view 4.2x more products per session, which naturally leads to higher repeat purchase rates. A mobile website is designed for a transaction; a mobile app is designed to build a relationship, turning a casual visitor into a loyal fan.4. The High-Cost Trap of "Effective" Marketing ChannelsEven marketing channels that seem effective can become a financial trap at scale. SMS marketing is a perfect example. While it boasts excellent open rates, its cost structure is linear: the more you message your customers, the more you pay. With per-message costs ranging from $0.0073 to $0.02, a brand sending frequent campaigns to a large list will see its budget swell in direct proportion to its communication efforts.This stands in sharp contrast to push notifications sent from a mobile app. Once a user has your app, you can send them unlimited notifications with zero marginal cost. This freedom allows you to test, optimize, and engage your audience without financial penalty. Even better, this zero-cost option is also incredibly effective, with push notifications documented to boost customer retention by up to 190%. It forces a critical shift in how leadership should view marketing expenses.The principle of Loss Aversion dictates that the psychological pain of incurring a loss is twice as powerful as the satisfaction derived from an equivalent gain. The constant, variable outflow of CPA and per-message costs should be perceived not as a manageable operating expense, but as a continuous, avoidable financial loss.5. The Real Value of a Customer Isn't What You ThinkThe single most impactful financial argument for an owned channel is its effect on Customer Lifetime Value (LTV). The data is decisive: users engaged through a mobile app generate 3x to 5x higher LTV than customers who only interact with the mobile website.In practical terms, this completely reframes the math of customer acquisition. A $50 CAC might seem high, but it becomes highly sustainable if that customer is 300% more valuable over their lifetime. The initial acquisition cost is amortized over a far more profitable long-term relationship.Investing in an owned channel like a mobile app isn't just another marketing tactic. It's an investment in a compounding financial asset. It doesn't just find you customers; it fundamentally increases the value of every single customer you acquire.Conclusion: The Choice Between Renting and OwningThe choice for modern e-commerce brands has become crystal clear: you can either continue to "rent" your customer relationships on third-party platforms or you can choose to "own" them through a dedicated asset like a mobile app. Renting guarantees a future of rising variable costs, financial dependency, and restricted communication. Owning transforms that recurring expense into a fixed-cost asset that provides unlimited communication at zero marginal cost.This shift moves your brand from a position of financial fragility to one of strength and control. The question for brand leaders is no longer whether they can afford to build an owned channel, but rather, how much longer can they afford the cost of not doing so?