The Hidden Financial Leak Sinking Your Brand: Why Renting Customers Is a Losing Strategy

Part of the Think Mobile Apps Are a Luxury? Here's the Data That Proves They're a Financial Necessity series.

1. Introduction: The Frustrated Scaler's Dilemma

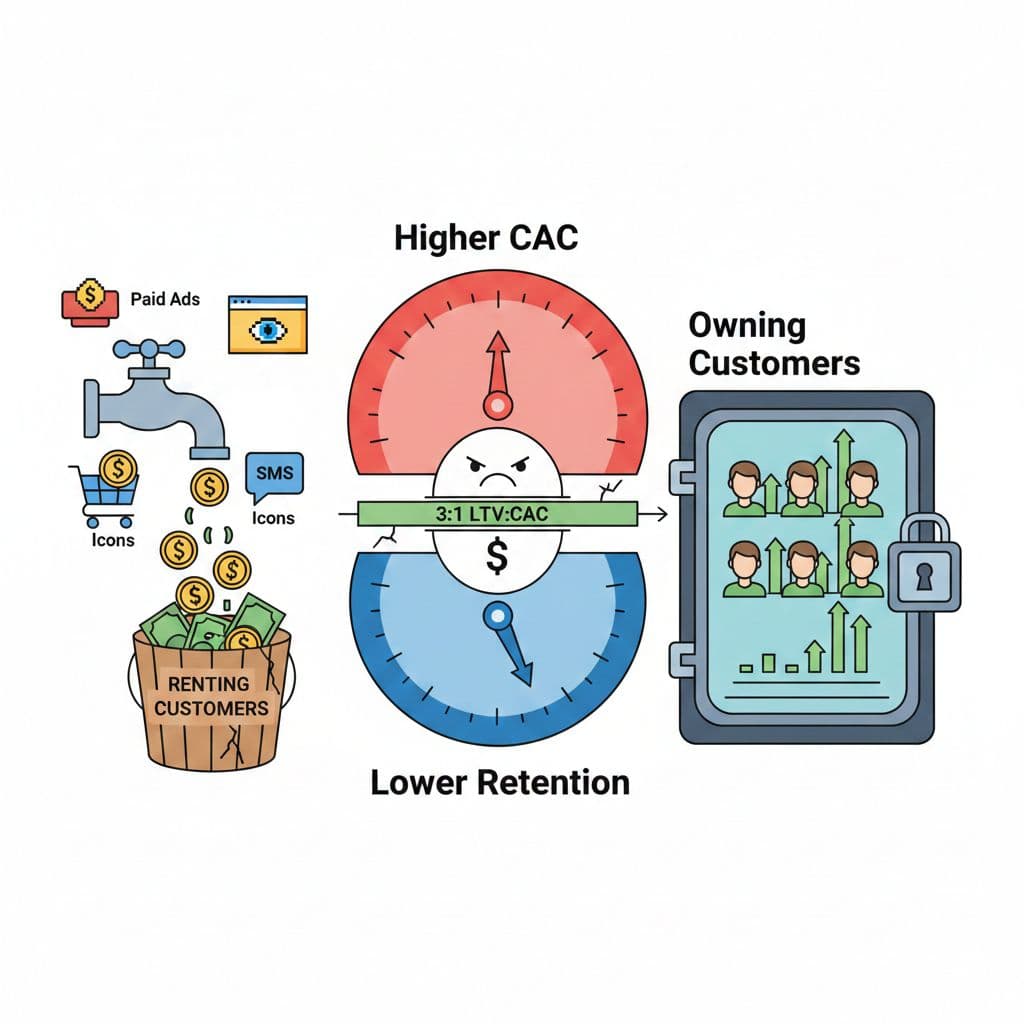

For e-commerce founders and marketers, the path to scale has never been more challenging. You’re navigating a landscape where the cost to acquire a new customer (CAC) is up 5.13%, while 75% of companies are reporting that customer retention is falling. This creates a painful squeeze on profitability, threatening the crucial 3:1 LTV to CAC ratio that defines a healthy business. To combat this, most brands double down on what they know: paid ads, retargeting campaigns, and SMS marketing to bring customers back.

But what if these standard retention tactics are the problem? What if, instead of solving the issue, they are a hidden financial drain, a perpetual "rent" you pay just to speak to the customers you already acquired? This isn't just a cost of doing business; it's a fundamental flaw in a model that prioritizes renting audiences over owning them.

This article will reveal the surprising ways your brand is losing money through its retention strategy. More importantly, it will show how a strategic shift from renting to owning your customer relationships can stop the bleed, transform your unit economics, and build a more profitable, defensible business.

.png)

2. You're Paying a "Tax" to Talk to Your Own Customers

Think about the channels you use to re-engage past shoppers, like Meta and Google. These are Rented Channels—closed ecosystems often called "Walled Gardens" that control access to your audience. After you’ve paid to acquire a customer, these platforms charge you again, and again, just to communicate with them. It’s like having to pay a fee every time you want to call a friend who is already in your phone’s contacts.

This "tax" comes in the form of retargeting costs. To show an ad to your own customer list, you typically pay a Cost Per Mille (CPM) ranging from $5 to $15. More alarmingly, these retargeting campaigns can consume a staggering 15–30% of a brand's total paid media spend. You are paying a significant portion of your budget for access to a relationship you should already own.

This dependency on rented channels means you never truly own your customer data or control your financial future. Your ability to communicate is subject to the platform's changing algorithms and rising costs, creating a fragile foundation for growth.

3. The Staggering Difference Between a Visitor and a Fan

The gap between how a customer behaves on a mobile website versus a dedicated mobile app is shockingly wide. The data reveals that the two experiences create fundamentally different relationships with your brand.

On a broad level, app users spend 7x more time in mobile apps than on mobile websites. When you isolate shopping behavior specifically, the disparity becomes even more pronounced. E-commerce app users spend an average of 201.8 minutes per month shopping. In stark contrast, mobile website users spend just 10.9 minutes per month. That's an 18.5x increase in engagement time.

Why does this matter? More time leads to deeper brand loyalty and more purchasing activity. App users view 4.2x more products per session, which naturally leads to higher repeat purchase rates. A mobile website is designed for a transaction; a mobile app is designed to build a relationship, turning a casual visitor into a loyal fan.

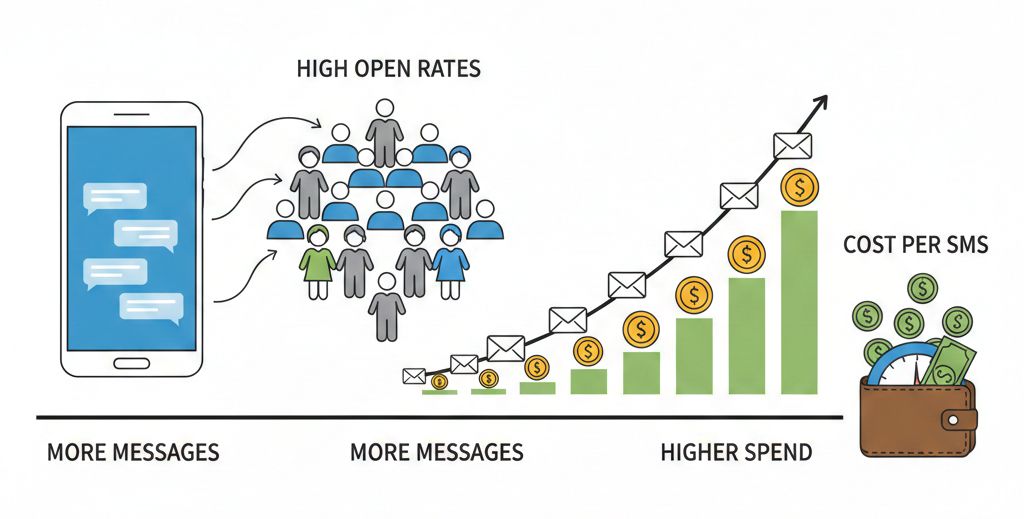

4. The High-Cost Trap of "Effective" Marketing Channels

Even marketing channels that seem effective can become a financial trap at scale. SMS marketing is a perfect example. While it boasts excellent open rates, its cost structure is linear: the more you message your customers, the more you pay. With per-message costs ranging from $0.0073 to $0.02, a brand sending frequent campaigns to a large list will see its budget swell in direct proportion to its communication efforts.

This stands in sharp contrast to push notifications sent from a mobile app. Once a user has your app, you can send them unlimited notifications with zero marginal cost. This freedom allows you to test, optimize, and engage your audience without financial penalty. Even better, this zero-cost option is also incredibly effective, with push notifications documented to boost customer retention by up to 190%. It forces a critical shift in how leadership should view marketing expenses.

The principle of Loss Aversion dictates that the psychological pain of incurring a loss is twice as powerful as the satisfaction derived from an equivalent gain. The constant, variable outflow of CPA and per-message costs should be perceived not as a manageable operating expense, but as a continuous, avoidable financial loss.

5. The Real Value of a Customer Isn't What You Think

The single most impactful financial argument for an owned channel is its effect on Customer Lifetime Value (LTV). The data is decisive: users engaged through a mobile app generate 3x to 5x higher LTV than customers who only interact with the mobile website.

In practical terms, this completely reframes the math of customer acquisition. A $50 CAC might seem high, but it becomes highly sustainable if that customer is 300% more valuable over their lifetime. The initial acquisition cost is amortized over a far more profitable long-term relationship.

Investing in an owned channel like a mobile app isn't just another marketing tactic. It's an investment in a compounding financial asset. It doesn't just find you customers; it fundamentally increases the value of every single customer you acquire.

Conclusion: The Choice Between Renting and Owning

The choice for modern e-commerce brands has become crystal clear: you can either continue to "rent" your customer relationships on third-party platforms or you can choose to "own" them through a dedicated asset like a mobile app. Renting guarantees a future of rising variable costs, financial dependency, and restricted communication. Owning transforms that recurring expense into a fixed-cost asset that provides unlimited communication at zero marginal cost.

This shift moves your brand from a position of financial fragility to one of strength and control. The question for brand leaders is no longer whether they can afford to build an owned channel, but rather, how much longer can they afford the cost of not doing so?