Your Mobile Website Is Secretly Costing You Millions. Here's How.

Part of the Think Mobile Apps Are a Luxury? Here's the Data That Proves They're a Financial Necessity series.

Introduction: The Mobile Paradox

E-commerce leaders face a frustrating reality. Mobile devices drive the overwhelming majority of traffic—often 70-75% of all visits—yet conversion rates remain stubbornly low, hovering between 1.57% and 3%. This gap between massive traffic and disappointing revenue is not a minor issue to be optimized; it is a structural financial hemorrhage. For too long, reliance on a mobile-web-first strategy has been viewed as a neutral technology choice. It is now an active liability that erodes EBITDA.

This analysis exposes the hidden costs your business pays every day for this liability. We call it the "Silent Tax"—a constant drain on your profitability levied through two compounding vectors: the crippling financial penalty of latency and the ever-increasing cost of wasted ad spend.

1. You're Being Penalized for Being Slow (And You're Slower Than You Think)

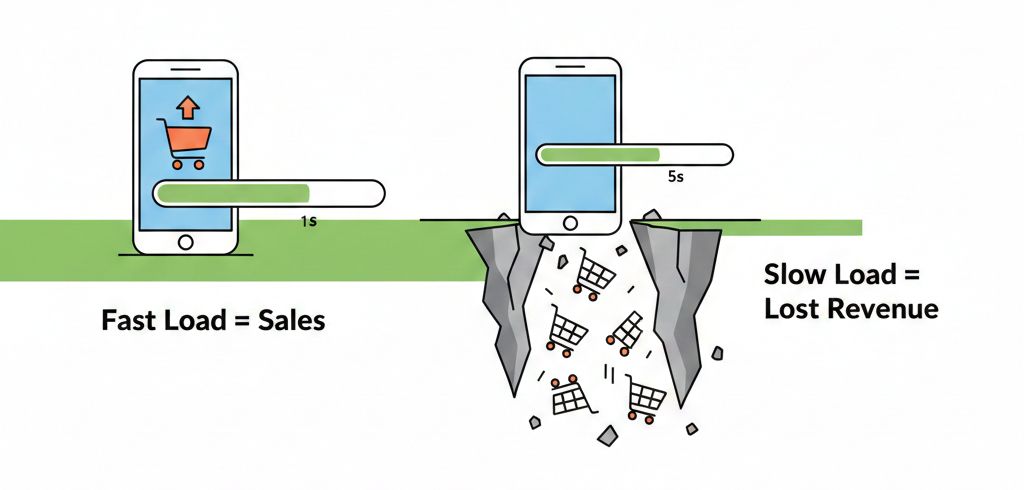

The relationship between your mobile site's loading speed and your revenue is not linear—it is an exponential cliff. The longer a customer waits, the less likely they are to ever complete a purchase. This is the latency penalty.

The core statistic is staggering: for every one-second delay in mobile page load time, conversion rates drop by approximately 20%. This penalty accumulates with breathtaking speed. Research shows that 53% of mobile users will abandon a site completely if it takes more than three seconds to load. In practical terms, this means for every $100,000 you spend on ads, $53,000 is incinerated before a user even sees a single product.

"A mobile site that loads in 4 seconds is not merely 'slower' than a site that loads in 2 seconds; it is structurally incapable of generating the same revenue volume."

Native apps solve this problem through architectural superiority. Unlike a website that must fetch its interface from a remote server on every visit, a native app stores its core user interface on the device’s local NAND flash memory. This provides "Zero Network Dependency for UI," leveraging hardware acceleration to make the experience feel instant, eliminating the cognitive drift that kills conversions.

2. You're Paying Rent to Talk to Your Own Customers

For years, the standard e-commerce playbook has been to pay platforms like Meta and Google to constantly "retarget" and re-acquire your own customers. This "Rentership Economy" is a fundamentally broken model that destroys the unit economics of the business.

Customer Acquisition Costs (CAC) have surged by 40% to 60% over the last two years, making this rental model financially unsustainable. The problem is compounded by the "Signal Loss" crisis. Privacy changes like Apple's App Tracking Transparency (ATT) and the end of third-party cookies have decimated the fidelity of retargeting through two mechanisms:

• Match Rate Collapse: The inability to reliably identify your website visitor as the same user on Instagram or Facebook.

• Attribution Obscurity: The inability to accurately track which ads lead to sales, forcing brands to fly blind with their ad spend.

A native app offers an escape from this rental trap through an "owned" model. Push notifications provide a direct, free, and algorithm-proof line of communication to your customers, fundamentally altering the economics of retention.

"The shift to an app is a shift from 'OpEx' (Paid Media) to 'Asset Utilization' (Owned Media)."

3. Your App Isn't an 'IT Expense'—It's Your Most Valuable Real Estate

A fundamental psychological shift occurs when a customer installs your app. A mobile website is a "destination" they must actively seek out. A native app is a "resident" on their device's home screen—the most valuable digital real estate in the world.

This constant presence creates a "Default Bias," building habit loops and serving as a persistent brand impression that the mobile web can never replicate. Furthermore, the app functions as a competitive "Moat." Once a user is inside your app, they are insulated from the Google Shopping ads and competitor promotions that litter the open web.

For this reason, brands must stop viewing an app as an "IT expense" and start seeing it as a financial asset, akin to a flagship physical store. The Cost of Inaction (COI) quantifies this. Consider a hypothetical "Brand X" with $20 million in annual revenue. By migrating just 20% of its loyal customers to a native app that converts at a conservative 3x higher rate, the company could be paying a "Silent Tax" of over $6 million per year in lost revenue and wasted marketing spend.

"The debate should not be 'Can we afford the development cost?' but rather 'Can we afford the OpEx of not having this asset?'"

Conclusion: Stop Paying the Tax

The "Silent Tax" of mobile web latency and ad spend wastage is not a theoretical concept; it is a real, quantifiable, and growing drain on your brand's profitability.

The native mobile app is no longer a vanity project; it is a fundamental instrument of risk mitigation and capital efficiency. It is a massive profit reclamation engine. Beyond solving for latency and retention, an owned app channel serves as a critical hedge against market volatility. When ad costs spike in Q4, an app-centric brand is insulated because a large portion of its revenue comes from free, owned channels, not volatile paid auctions.

The native mobile app is the necessary survival gear for scaling brands in a high-friction, high-cost digital environment. The cost of inaction is now clear. How much longer can your business afford to pay the Silent Tax?