4 Surprising Truths About Mobile Apps That Will Change How You Think About Growth

Part of the Think Mobile Apps Are a Luxury? Here's the Data That Proves They're a Financial Necessity series.

Introduction: The Mobile Paradox

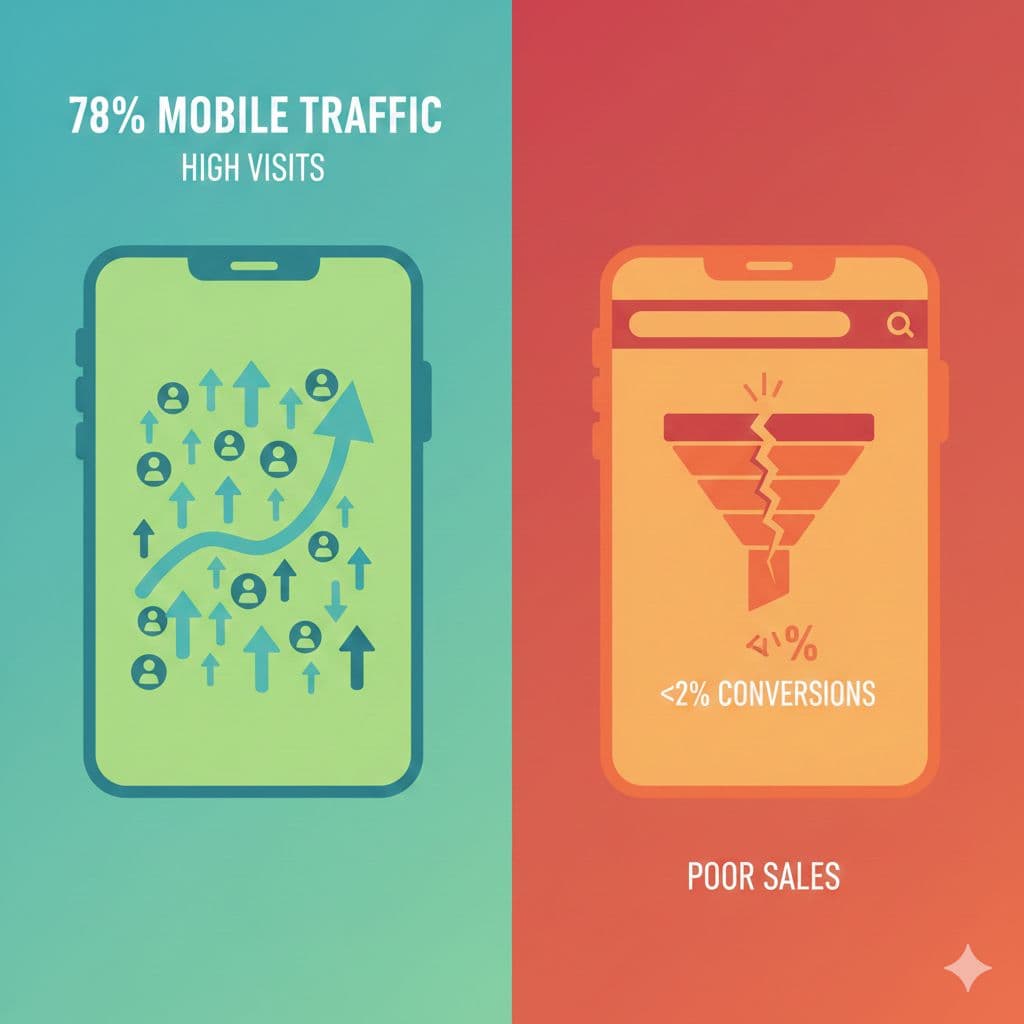

If you're leading a growing business, you've likely felt this frustration: you look at your analytics and see the vast majority of your web traffic—around 78%—is coming from mobile devices. Yet, when you look at your sales data, you see that the conversion rate on the mobile web is stubbornly low, often under 2%.

This is the Mobile Revenue Paradox. Companies are spending significant capital to acquire traffic that arrives through a channel that is fundamentally inefficient at converting it. It’s like pouring water into a leaky sieve. You're paying for potential customers who show interest but disappear before they can complete a purchase, threatening the long-term unit economics of your business.

The common response is to avoid investing in a native app, fearing it will only "cannibalize" sales from the website without adding new revenue. But this fear is based on a fundamental misunderstanding of modern digital economics. Here are four surprising truths that challenge this old way of thinking and reveal where real mobile growth comes from.

1. The "Cannibalization" Myth: Apps Don't Steal Sales, They Save Them

The most common objection to building an app is the fear of "cannibalization"—the idea that an app only shifts your existing customers from the website without generating new revenue, all while adding significant cost.

This view, however, fails to account for the enormous "friction cost" of the mobile web experience. The browser is an environment plagued by issues like slow load times, session volatility, and a lack of persistent identity, creating a path to purchase filled with obstacles:

• Login Fatigue: The constant and annoying need to sign in, often after forgetting a password.

• Cumbersome Checkouts: The difficulty of entering detailed payment and shipping information on a small screen.

• High Cart Abandonment: As a result of these frustrations, an astonishing average of 85.65% of mobile shopping carts are abandoned before purchase.

This isn't cannibalization; it's loss prevention. Given that 85.65% of mobile web carts are abandoned, revenue shifted to an app is revenue rescued from the brink of abandonment. The app's role isn't that of a cannibal, but of a rescue mechanism that saves fragile revenue and reduces churn among your most valuable customers.

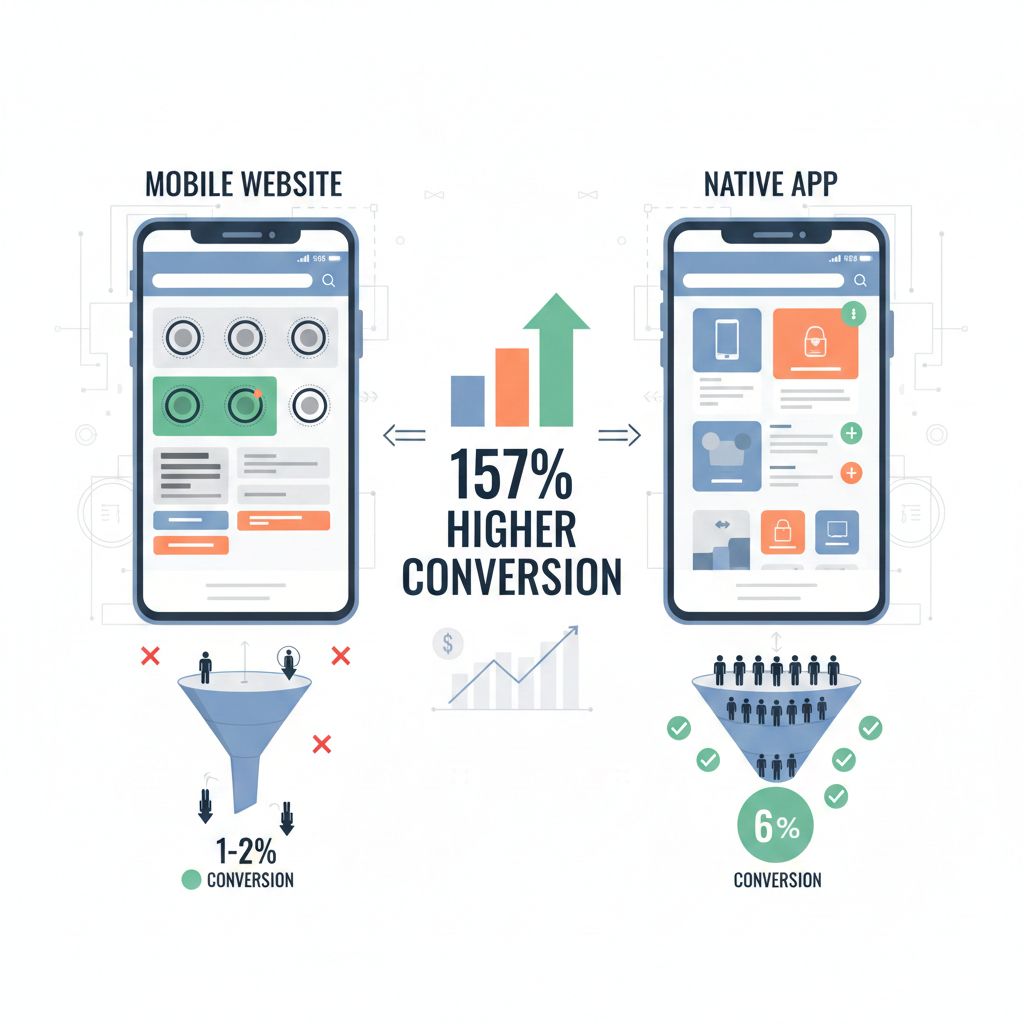

2. The Conversion Gap: A 157% Lift Isn't a Typo, It's the Standard

The most immediate and undeniable source of new value from an app is its dramatically higher conversion rate. While mobile web conversion rates languish around 1-2%, native app conversion rates frequently hit 6% or higher. This is the efficiency gap where incremental revenue is born.

Data indicates that mobile apps convert at rates 157% higher than mobile websites.

This performance gap is not accidental; it is the direct result of superior engineering. Native apps offer a superior user experience (UX) with faster load times and remove the biggest barriers to completing a purchase. With seamless, one-click payment integrations like Apple Pay and Google Pay, the checkout process goes from a tedious chore to an effortless action.

These are not cannibalized sales. This is realized potential that the mobile web was incapable of capturing. The app unlocks revenue from users who had the intent to buy but were stopped by the friction of the browser experience—revenue that simply would not have existed otherwise.

3. Beyond the First Purchase: Apps Create "Super Users" with Up to 7x Higher Lifetime Value

While the initial conversion lift is powerful, the true long-term value of an app lies in its ability to fundamentally change customer behavior. This stems from a core strategic difference: the mobile web is "rented" attention, while an app is "owned" real estate on a customer's home screen.

This ownership fundamentally alters engagement patterns. The data shows that app users have a 2x higher repeat purchase rate and spend 3-5x more time engaging with the brand. A key driver is the push notification—a direct, zero-cost re-engagement channel with open rates hovering around 60% and click-through rates of 15%. This allows you to bring customers back without paying for expensive retargeting ads.

When you combine higher conversion rates, more frequent purchases, and a lift in Average Order Value (AOV) of +10% to +50%, you dramatically expand customer Lifetime Value (LTV). The data is unequivocal: app users can generate a lifetime value that is 3.5 to 7 times higher than mobile web users. The goal is not just to make a sale; it's to upgrade a casual customer into a high-value, long-term asset.

4. Your App Isn't an Expense—It's a Balance Sheet Asset

Perhaps the most surprising truth is how a mobile app is viewed from a financial and strategic perspective. Many leaders see an app as a major marketing expense (OpEx) that will hurt short-term profits. However, under US GAAP, specifically ASC 350-40, the accounting treatment is far more strategic.

App development costs are segmented into three stages. The "Preliminary Project Stage" (ideation, vendor selection) is expensed (OpEx). However, the bulk of the cost—the "Application Development Stage" (design, coding, testing)—is capitalized (CapEx). The final "Post-Implementation Stage" (maintenance, training) is again treated as an expense.

This has profound strategic importance. By capitalizing the core development cost, the app is treated as a long-term intangible asset on your company's balance sheet, much like property or equipment. This enhances your company's enterprise value, making it more attractive to investors. It transforms the app from a "cost center" into an investable asset that represents true digital sovereignty—ownership of your customer relationships, independent of third-party platforms.

Conclusion: The Real Cost of Doing Nothing

The long-held fear of cannibalization ignores the very real, ongoing cost of mobile web friction and inefficiency. The data is clear: an app is not a luxury channel for a select few, but a strategic tool for converting traffic, retaining customers, and building tangible enterprise value.

By shifting your perspective, you can see that an app doesn't steal sales—it saves them. It doesn't just shift revenue—it creates new revenue by closing the conversion gap. And it doesn't just cost money—it builds real, measurable value on your balance sheet.

This leads to a final, critical question. In an economy where 78% of your traffic arrives through a channel that converts at less than 2%, the real question isn't "Can we afford an app?" but rather, "How much longer can we afford the cost of inaction?"